Whitepaper: If It Ain't Broke, Fix It

This whitepaper provides background information on the industry, highlights the increasing margin pressure, and identifies an innovative approach to reducing SG&A costs. Fill out the form to read more!

Blurring the lines between health and tech has been a trend for years. Adding a layer of financial technology, aka “fintech,” can propel the transformation, but we are still in the early days of the adoption of these technologies by the healthcare industry. triValence is making this breakthrough opportunity a reality with its innovative and intelligent solution that simplifies the procurement-to-payment process for ambulatory surgery centers (ASCs) and non-acute providers.

Fintech and health-tech have long been buzzwords but are rarely used in the same sentence. While fintech has revolutionized how businesses interact with their customers in the retail world, financial products and services available to healthcare organizations are few. We spoke with John Mwangi, Vice President of Fintech Product Development at triValence, about how the company is leveraging the best of financial technology to optimize supply chain and expense management operations in the non-acute healthcare sector. John leads the team responsible for designing fintech products and forming strategic relationships with trusted financial partners, using their extensive experience in the fintech industry to elevate the payment experience for ASCs.

But for many, the complexities of modern financial transactions can be a bit of a mystery, so let’s start with the basics of what “fintech” really means. The term fintech, a combination of ‘finance and technology,’ is a catch-all term used to describe the trend of companies leveraging technology to improve how consumers and businesses manage and conduct financial transactions. It has seen its rise due to business and technology advances and trends in the last 10 years. “I always think of fintech as a beneficiary of macro consumer, business, and technology trends changing how society interacts across sectors,” John says.

Let’s consider the perspective of a consumer. “The way we shop today for goods and services has profoundly changed in the last decade. We live in an era when we are ‘always on’ and connected by phone, wearables, home, and other devices. We as consumers are demanding choice, convenience, control, and privacy as we interact with other businesses.”

As a result, business had to change how they operate to meet this demand and consumer expectations. They, too, must be ‘always on’ and meet their customers where they are. According to John, “Businesses have become more flexible and able to scale their digital capabilities and resources to create services at the point of need.” In the process, they discovered they couldn’t do this alone. “This is what gave rise to an entire ecosystem of companies removing the pain points by providing services which deliver the experience consumers demand.”

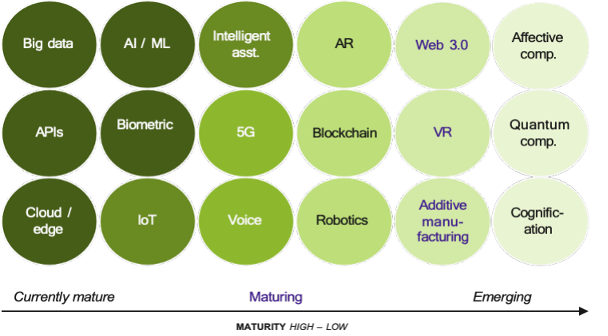

None of this would be possible without advancements in technology that are underpinning the changes in consumer and business trends. It is the enablement layer of various technologies that make it possible to deliver truly differentiated experiences.

“This cumulative effect of various technology advancements and trends coming together have led to the growth of the fintech industry,” John says. “From connected devices changing the way financial products are delivered to consumers, to the rise of APIs which enable us to build truly embedded financial products across industries, to the growth of Artificial Intelligence (AI), which has made it possible to use massive amounts of data to better prevent fraud, build personalized financial services and predictive models, to the emergence of cloud computing that has allowed fintech providers to scale computing resources and build storage and resiliency on demand – all this conspired to allow companies to provide a banking and payments experience to their end-customers in a seamless, convenient, and secure way,” John explains.

The same consumer, business, and technology trends that have brought about the fintech industry have the potential to significantly improve how ASCs operate and manage their supply chain processes. “At triValence, we believe that ASC staff should have the same experience and convenience when they purchase and pay for the equipment at work as they have when shopping and banking at home,” says John. “Instead, the current supply chain and payment processes are manual and labor intensive. They obscure visibility into payment flows, stifling the ASC’s potential growth.”

Leaning in on fintech will be even more critical as ASCs and other healthcare providers are under pressure to reduce their costs and enhance staff efficiency amidst the ongoing labor shortage, tightening reimbursement, and rising supply expenses.

The unique aspect of the triValence platform is that it combines fintech and healthcare technology to deliver the integrated experience that the modern-day ASC is seeking. “We are leveraging the same consumer, business, and technology trends that are routine in other areas of our life, including fintech, but tailoring them in a way that meets the needs and expectations of healthcare providers,” John explains. “We work with bank partners, technology providers, payment networks, and others to deliver a payment functionality embedded in our platform, allowing ASCs to make purchase orders, receive goods, process invoices, view account balances, and make payments from one integrated solution.”

As a highly regulated sector, banking and financial services require steps that don’t apply to healthcare. For example, to protect the financial industry from bad actors, banks and financial institutions are required to conduct due diligence to verify that the businesses they work with are in good standing and are not on any sanctions list in a process referred to as KYB (Know Your Business) and KYC (Know your Consumer). To deliver an embedded payment product, we collect this information to facilitate the KYB and KYC process through our software, bringing together the convenience of delivering an integrated solution with the safeguards of protecting both healthcare and financial industry providers from bad actors.

Before joining triValence, John spent his career in multiple roles spanning product management and strategy at Mastercard. He previously held various roles in multiple global organizations, including PayPal, Deloitte, and Action Against Hunger.

“Building the platforms of the future will require cross-pollination of ideas, technology, and talent from different industries. With triValence, I saw an opportunity to work with the best minds in healthcare to build an intuitive platform that connects the proven tools of the financial services industry with the unmet needs in the non-acute care sector in a way that creates tremendous value for healthcare providers,” he says.

“Imagine if you had to use a rideshare app that required you to order a ride in one, track the ride using a separate mapping app, pay using a different app and get receipts through another. If we don’t accept that experience in our personal lives, why do we tolerate it in ASC procurement platforms? This is what we are working to change, and fintech is a critical component of reimagining the procurement to payment ecosystem in healthcare.”

For more insights into how technology is transforming the payment process for ASCs, read our earlier blog.

Subscribe today to stay informed and receive regular updates from triValence.